The proportion of homes sold to landlords has hit a five-year high but buyers are paying above asking price due to the lack of supply.

The latest Hamptons Lettings Index has revealed that the share of homes bought by landlords across Great Britain rose from 12.0% in the first quarter of 2021 to 13.9% in the first three months of this year.

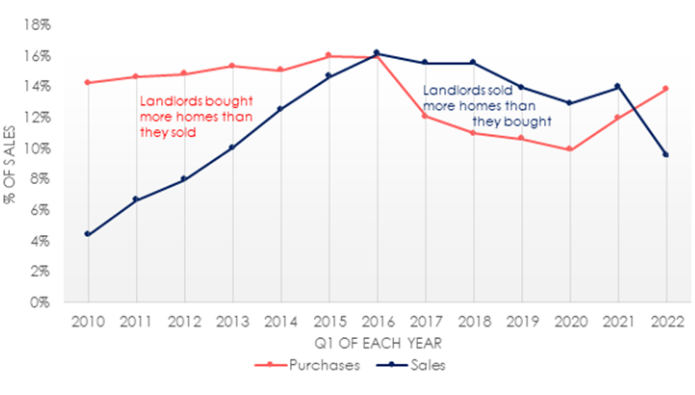

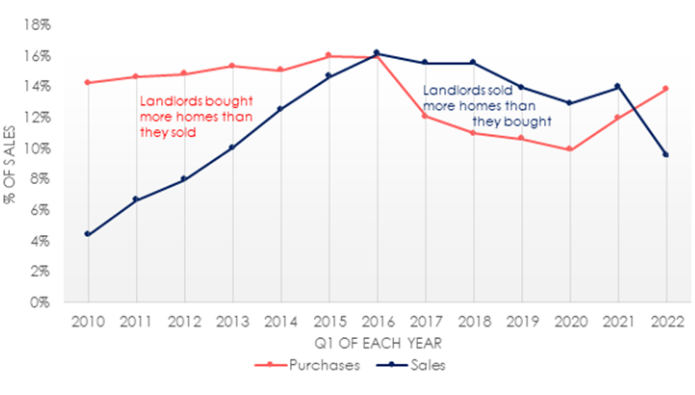

That is the highest proportion recorded in the first quarter of any year since 2016 when investors rushed to beat the 3% stamp duty surcharge on second homes in April 2016.

The research also found that buy-to-let investors are now purchasing more homes than they are selling for the first time since 2016.

The share of homes sold by investors fell from 14% in 2021 to just 10% in the first quarter of 2022, the lowest proportion in 10 years.

Overall, investors purchased 42,980 homes across Great Britain during the first three months of this year, equating to £8.5bn worth of property - almost twice the figure) recorded pre-Covid in the first quarter of 2019.

However, Hamptons warns that a lack of stock available to buy has meant that investors are increasingly having to pay over the asking price.

Competition from other buyers has meant that so far this year 40% of landlords have had to pay over the asking price for their new buy-to-let.

The average investor is paying more than 100% of the asking price for a buy-to-let in England & Wales for the first time since Hamptons started recording data for its index.

The north east of England is the buy-to-let capital of Great Britain, where investors purchased 27.7% of homes sold in the first three months of this year, more than twice the share bought by first-time buyers, according to the research.

It is also the region that saw the largest year-on-year rise in buy-to-let purchases.

Aneisha Beveridge, head of research at Hamptons, says: “Tax and regulatory changes have weighed heavily on the buy-to-let sector over the last five years causing more landlords to sell up at a time when fewer new entrants were looking to buy. As a result, there are around 300k fewer privately rented homes in Great Britain today than at the peak of the sector in 2017.

“While we expect investors to continue purchasing at around the same rate over the course of 2022, it’s unlikely to be enough to make up for the full loss of rental homes during the last five years.”

.png)

.png)

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment