Houses are taking longer to sell than at any time for at least six years, spending an average of five months on the market.

Before the credit crunch, average time on the market was two months.

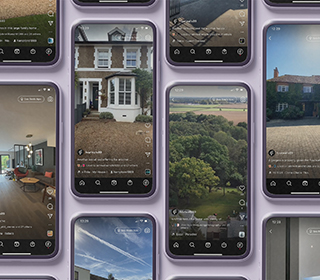

According to Home, which uses data from virtually every property portal and website in the UK, time on the market has risen to 241 days, the longest since its records began in 2004.

It says that last year, asking prices barely changed, moving up by just 0.6%. However, big regional variations meant that asking prices went up by 2.3% in East Anglia and down by 2.1% in Wales.

The site is predicting a slow market this year, accompanied by slowly falling prices.

The site said: “As we move into the New Year, it is becoming clear that the seasonal slowdown is more severe than this time last year.

“The fact that average time on market for unsold property across the UK is now at an all-time high of 241 days suggests that home prices are simply too high.”

The site is also predicting that more repossessions will be placed on the market as lenders’ forbearance wanes.

.png)

.png)

Comments

Ray Evans wrote: 'Prices not necessarily so, although there are exceptions. Reasonable finance availabilty for FTB's is still one of the major restrction (note the word 'reasonable')

How would you define 'reasonable'?

Given that mortgages last 25 years, most couples will lose earning power during that period when they have children and need a bigger home and given that, against the backdrop of globalization, wage inflation is by no means guaranteed.

And, based on whatever you think is 'reasonable' finance availability for FTBs, by what percentage would property in your area have to fall to be reasonably affordable to the average FTB?

No surprise here. It takes a while to fit in all the reductions from the initial deluded asking price.

241 days is in fact 8 months...

If only sales were taking an average of 5 months...

Slooooooooow market this year I suspect...

The Count(er)

241 days is five months... Are the length of months being seasonally adjusted now?

...........“The fact that average time on market for unsold property across the UK is now at an all-time high of 241 days suggests that home prices are simply too high.”................

Prices not necessarily so, although there are exceptions. Reasonable finance availabilty for FTB's is still one of the major restrction (note the word 'reasonable')