SmartSearch

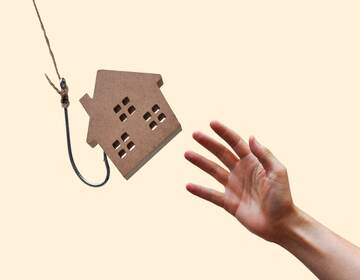

Stamp duty cut - much needed boost or short term fix? Either way, estate agents need to prepare for the rush

17 October 2022 7982 Views

The Government’s mini budget on September 23 was anything but ‘mini’ with several major announcements one of the most significant of which was the confirmation of the much-rumoured Stamp Duty cut.

The stamp duty threshold has been frozen at £125,000 for homemovers since 2010, and at £300,000 for first time buyers since 2017, but in the most significant, permanent amend to the rules in over a decade (stamp duty holidays during 2021 did see the limits raised temporarily) – the previous Chancellor Kwasi Kwarteng removed the 2% band and announced that homemovers will now pay no stamp duty on properties up to £250,000. He also confirmed that the threshold for first-time buyers would increase from £300,000 to £425,000, and then 5% on the next £200,000.

In his statement, Kwarteng called the reforms – which also included major tax cuts, including the abolition of the 45p rate, which he later u-turned on following huge backlash – “the biggest package in generations” sending a “clear signal that growth is our priority.”

And the stamp duty announcement particularly has certainly divided opinion within the housing industry, with some property experts calling it a short-term fix which will ‘pump up house prices’ and make the housing crisis ‘worse not better’ as first-time buyers clamour to buy under the new rules.

However, others have applauded the decision, saying that the stamp duty holiday during covid was a great success, and really helped boost the market when it was needed most, so welcome a return to the higher thresholds, calling the decision a big win for first time buyers.

And while it remains to be seen what the long-term impacts of the decision will be, in the short term, the cut in stamp duty will likely put paid to fears of a looming market slow down, and estate agents should be prepared for a return of the stamp duty holiday spurred charge of buyer activity seen during the pandemic.

And while an impending influx of new buyer activity is certainly welcome news for estate agents, it can also be risky, particularly for agents who still rely on manual customer checks, as Martin Cheek, MD at AML experts SmartSearch explains.

“Many property experts are predicting that unless inflation falls more quickly than expected we are going to see house prices fall significantly over the next few years, and this, combined with the stamp duty cut has created a real buyers’ market.

“The stamp duty cut benefits all buyers - but first-time buyers have been given the biggest cut - so we are likely to see a huge influx of people looking to take advantage of the lower band rates to take their first step onto the property ladder.

“This, combined with the fact there is still an extreme lack of stock will then create huge competition for those homes that are available, creating a very busy time for estate agents, meaning those agents who have traditionally taken manual approach to customer checks could really struggle.”

Martin says that when there is a flood of leads coming in, things like compliance and ensuring proper AML checks are still being completed, start to fall down the priority list.

“The UK property market is already one of the most vulnerable in terms of money laundering – and the sanctions imposed on Russia following the invasion of the Ukraine has heightened the risk even further with sanctioned individuals attempting to access funds and infiltrate the UK economy via the property market.

“So, when you create a high-pressure situation where first-time buyers are desperate to complete quickly while stamp duty is low and they have a mortgage rate they can still afford - estate agents are being pushed to close deals quickly, and compliance starts to slip. And when this happens, vulnerabilities are exposed, and this is where bad actors will start to take advantage, putting estate agents at risk of enabling financial crime, huge reputational damage and crippling fines for non-compliance.

“Those agents that already have efficient, electronic checks in place will be in a good position to cope with a sharp increase in onboarding, because they can run checks quickly and automatically creative audit trails to prove all their compliance is in order. But those who rely on manual checks and manual record keeping will struggle to run the checks properly, and given the heightened risks I outlined earlier, that is hugely dangerous.”

SmartSearch can offer an online AML platform that can onboard customers quickly, remotely, and securely, performing all the required compliance checks in seconds and creating a comprehensive audit trail to prove requirements have been met. Plus, thanks to SmartDoc - a biometric and liveness detection solution - estate agents that use SmartSearch are able to onboard customers remotely with complete accuracy, as Martin explains:

“By combining document authentication technology and the latest biometric verification and liveness detection techniques, our clients can gain an accurate picture of their customers, with no need for face-to-face interaction, meaning onboarding can be done quickly and efficiently to meet any sudden increase in demand.

“The SmartDoc technology verifies that the document is genuine and unaltered, and that it also belongs to the person presenting it. Then, using this information, our platform can screen the customer against sanctions and PEPs lists, and deliver the result in seconds.

“This not only means that agents can onboard customers quickly but also that they can onboard customers remotely, absolutely vital if they are to take advantage of the anticipated rush of new business.”

For a free demo on how SmartSearch can revolutionise your AML programme, visit https://www.smartsearch.com/get-a-demo”

Previous Articles

Estate Agents warned to ensure...

Compliance check list - are...

Estate agents urged to assess...