SmartSearch

As HMRC reveals almost half of those falling foul of AML regulations are property firms, estate agents are urged to get their compliance in order or face the consequences

17 August 2022 7155 Views

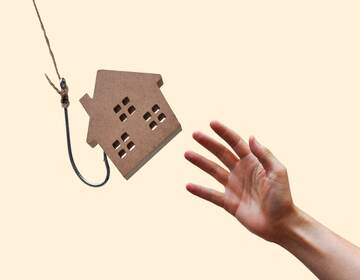

HM Revenue & Customs (HMRC) recently published a list of firms that have received penalty notices for failure to meet their anti-money laundering (AML) obligations, and almost half were in the property sector.

In a list of 79 firms that had breached AML regulations between April and December last year, more than 30 were estate agents, commercial property firms, valuers and auction houses, meaning property firms accounted for almost half (44%) of all AML breaches during that time period.

Why are HMRC clamping down on estate agents?

The property market is one of the most vulnerable sectors in the UK when it comes to money laundering due to the large sums involved and the fact that offshore companies can by UK property. And while owning UK property through an offshore firm is not illegal in itself, it enables the ultimate beneficial owner (UBO) to remain anonymous, which hugely heightens the risk of money laundering.

For example, if someone has gained their wealth illegally, they can set up an anonymous shell company in an offshore tax haven, transfer the dirty money into that company, and then buy property in the UK through that company. Once it is purchased, they can then live in that property or rent it out – which legitimises that cash. Then if they sell the property, whoever buys it has inadvertently helped enable money laundering by using their clean cash to buy it.

This growing problem was further highlighted last year when the Pandora Papers - almost 12million documents exposing the secret dealings and hidden assets of the world’s richest and most powerful - revealed that the UK property market was being abused to the tune of around £170bn via the illegal use of shell companies.

The rising value of homes in UK – especially in London – combined with the opportunities to hide the true source of funds makes the property market a clear target for criminals – and even terrorists – who are seeking to launder money, and as a result, over the past few years, the risk level of the property sector has moved from medium to high.

Why are so many estate agents failing to meet their AML obligations?

Despite the high - and ever increasing - levels of risk, and the fact that estate agents and other firms within the property sector are required to have proper AML systems in place, many are still failing to comply.

For a few, this is conscious – they are simply not taking their obligations seriously – but for the vast majority, keeping pace with the changing rules, and finding the time and resource to dedicate to AML, means it can sometimes be difficult to comply. This is especially true for those who have not made the switch to electronic verification and are still relying on manual checks, which according to recent research by SmartSearch is more than a third (34%). Not only are manual checks time consuming and cumbersome, as every check is done by hand, but they are also much less reliable, and during the pandemic - when lockdowns prevented face to face contact - were impossible to complete properly, leaving those firms relying on this method of verification vulnerable. But whether it is intentional or not, non-compliance is non-compliance, and HMRC is clamping down on those failing to put proper procedures in place.

What is the solution?

Some would argue that rather than putting the responsibility on estate agents and property firms, there should be more transparency around the owners of these properties so that they are not able to hide behind multiple corporate layers. If there was a clear line to the owner of a shell company, estate agents would be able to easily identify any suspect transactions before they happen. And the issue has been tackled – on numerous occasions – including the introduction of mandatory UBO registers back in 2017 however, due to the fact it is a global problem, which many of the countries involved have no interest in ‘fixing’ it is up to those on the front line of the UK property market to do everything they can to prevent it. And this means having systems in place to run proper due diligence not just on individuals, but also on corporate customers, with the ability to identify UBOs

Unfortunately, it can be very difficult for estate agents and other property firms to actually establish the identity of the UBO – especially when that individual is doing everything they can to stay anonymous. Those who want to keep their identity – and the true source of their funds - hidden are able to hire the best accountants, advisers and legal teams in the world to confuse the system, meaning estate agents often find themselves lost in corporate fog trying to establish who is at the top of the tree.

SmartSearch is an award-winning electronic AML platform that not only enables estate agents to quickly and efficiently run comprehensive checks on individual clients, but also run reliable and robust business checks on corporate customers. As well as verifying the corporate structure of the business, the check is also able to identify the owners and shareholders within that business, including the UBO. Once these individuals have been identified, the system runs full AML checks – complete with screening – on those names, giving estate agents a full understanding about the ownership of any corporate entities they wish to do business with.

Protect your business, avoid fines and save time and money

Not only does electronic verification offer the most reliable and robust way to verify individuals and corporate customers, it can also deliver a wide range of commercial benefits due to the speed at which checks can be completed and the fact the platform can be integrated into clients’ existing systems.

SmartSearch completes a full AML check in less than two seconds and can perform a comprehensive AML business check in less than two minutes. And through integration, clients can simplify their workflows and export data to ensure all information needed for audits and reviews is immediately accessible.

The system is affordable to estate agents of all sizes, as all users have access to the same functionality, which is constantly being improved and updated to ensure it complies with all the latest regulations, making legacy systems a thing of the past so clients are never wasting valuable time and resource on updating their AML systems.

Previous Articles

Estate Agents warned to ensure...

Compliance check list - are...

Estate agents urged to assess...